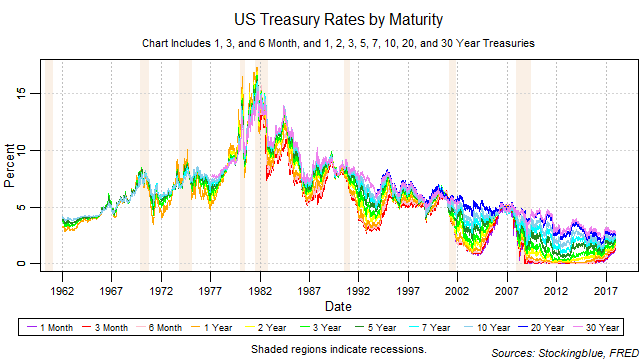

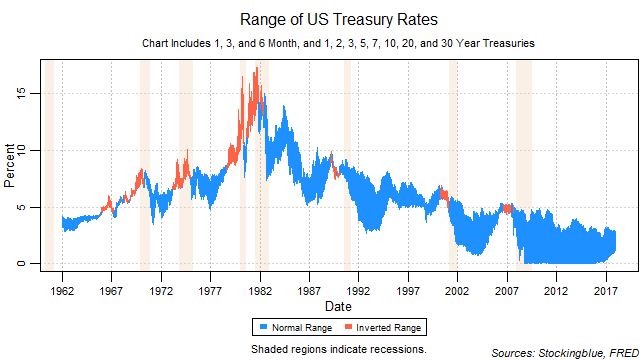

Short-term rates took a dramatic turn upwards after being stuck at zero for several years while long-term rates continued their slow and steady decline. The yield curve continued to narrow but it also narrowed from the bottom up. A narrowing from the short-term is a warning sign for an inversion that indicates recession.

Findings

- All rates from the one-month to the seven-year rose in 2017 while the 10, 20, and 30-year rates all dropped.

- The six-month rate saw the largest absolute growth at 0.92 points.

- The 30-year rate saw the largest drop at 0.31 points.

- On a relative basis, the three-month rate grew the most with a 172.55 percent rise.

- The 30-year rate dropped the most on relative terms with a 10.13 percent drop.

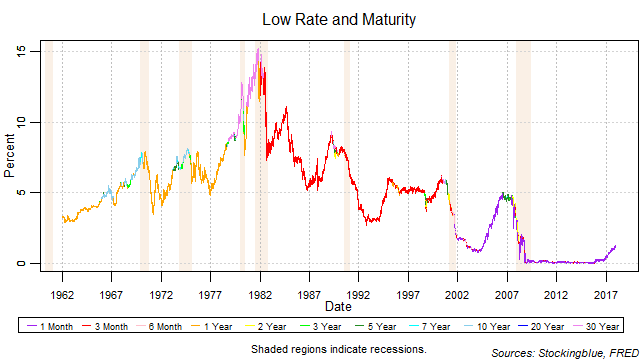

- The one-month bill did not maintain the lowest rate throughout the year.

- The yield curve narrowed 1.06 points.

Caveats

- As always, past performance is not indicative of future results.

- The rates have been at historic lows for quite some time which has not occurred previously.

Details

The breadth of the yield curve narrowed over the year from a range of 2.62 to a range of 1.56. The widest range was 2.69 on March 9 and the narrowest 1.44 on December 15.

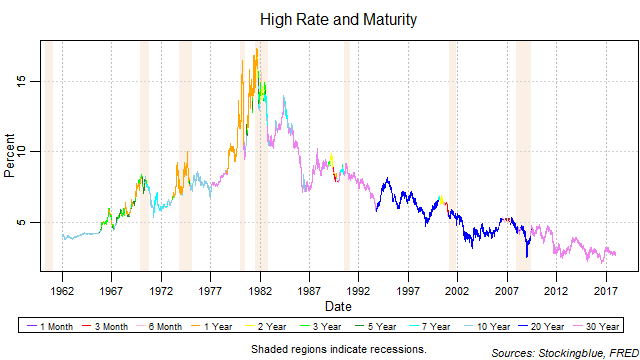

The thirty-year bond held the highest rate throughout the year, although the rate has been slowly trending downwards after peaking at the beginning of the year.

The one-month note held the lowest rate for nearly every session except on a couple of occasions in August and September. It has been rising steadily throughout the course of the year which is a troubling sign.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed December 30, 2017, https://fred.stlouisfed.org/categories/115.