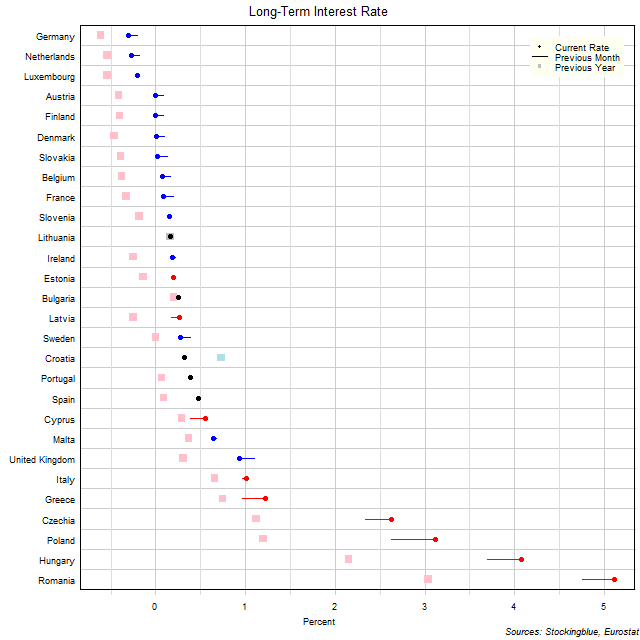

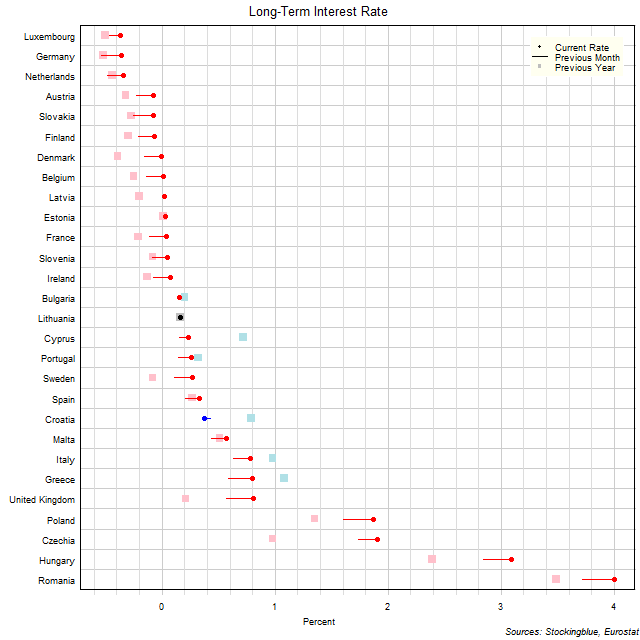

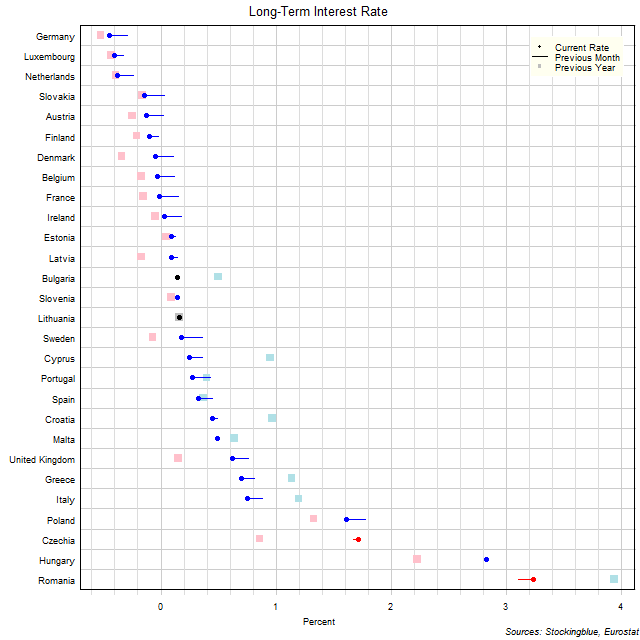

EU Long-Term Interest Rates, November 2021

The chart above shows the ten-year interest rate in each EU state as of November 2021, the change from the previous month, and the rate one year prior. Four states have a negative interest rate (up from 3 last month and down from 13 last year).

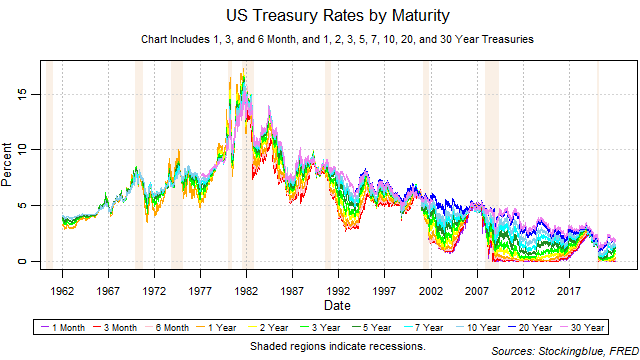

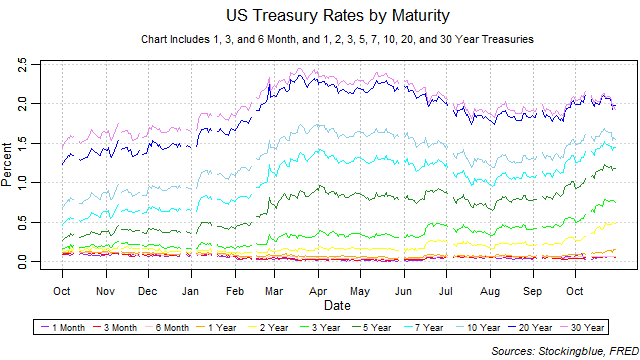

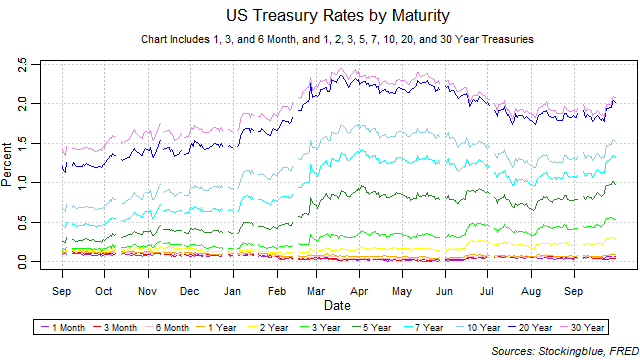

A Look Back at Treasuries in 2021

The one-month and three-month rates trended downwards for the third year in a row while all other rates went up ending their downward trend at two years. The yield curve widened over the course of the year. A narrowing from the short-term is a warning sign for an inversion that indicates recession.

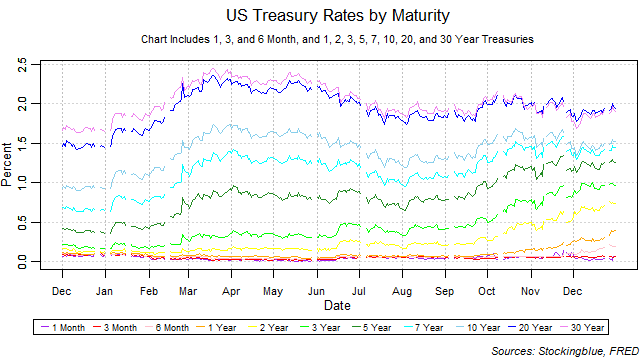

Treasury Rate Movements, December 2021

The one-month rate fell while all other rates rose in December. The yield curve widened from the previous month thus ending its narrowing streak at two months. The one-month bill did not maintain the lowest rate throughout the month and it shared the lowest rate. There were no major moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

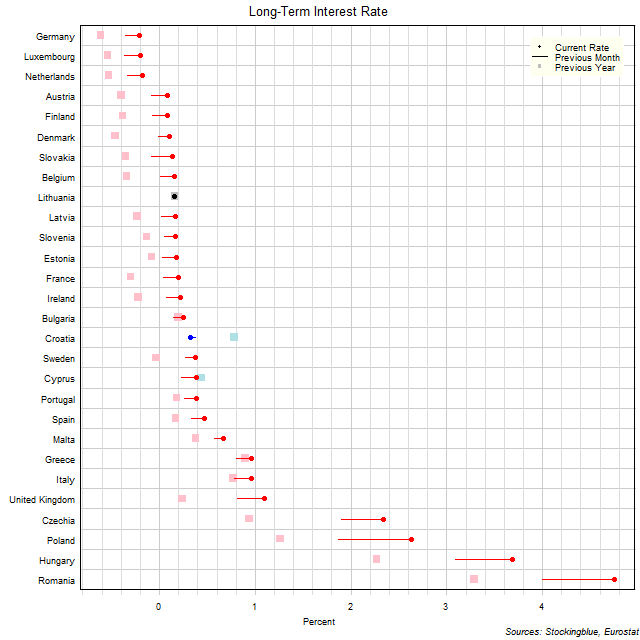

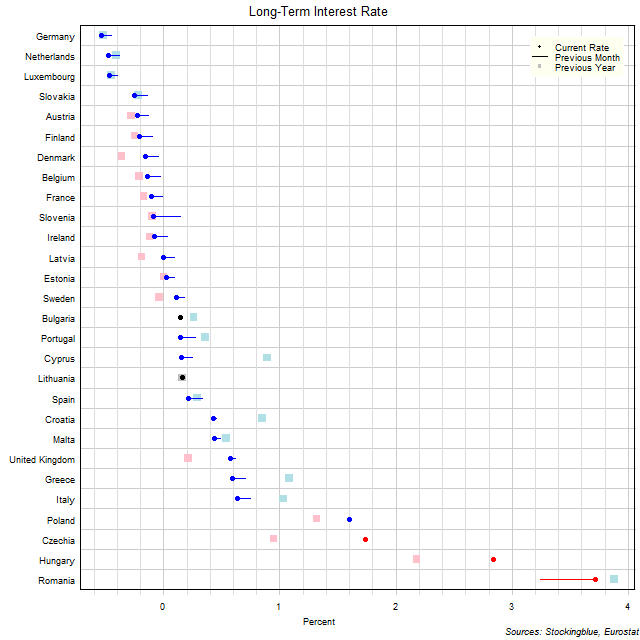

EU Long-Term Interest Rates, October 2021

The chart above shows the ten-year interest rate in each EU state as of October 2021, the change from the previous month, and the rate one year prior. Three states have a negative interest rate (down from 7 last month and down from 14 last year).

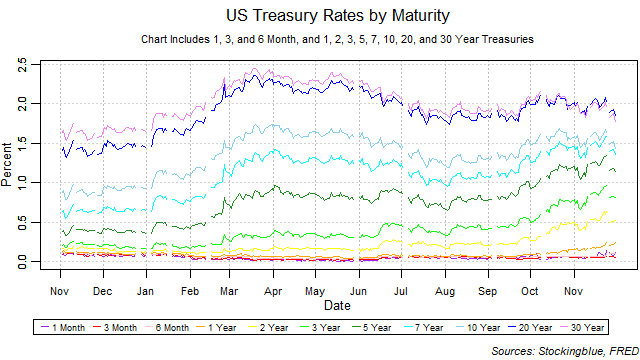

Treasury Rate Movements, November 2021

The five-year, seven-year, 10-year, 20-year, and 30-year rates fell, the three-month rate stayed the same, while all other rates rose in November. The yield curve narrowed from the previous month thus extending its narrowing streak to two months. The one-month bill did not maintain the lowest rate throughout the month and it shared the lowest rate on multiple occasions. There were moves upwards on short-term rates thus increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

EU Long-Term Interest Rates, September 2021

The chart above shows the ten-year interest rate in each EU state as of September 2021, the change from the previous month, and the rate one year prior. Seven states have a negative interest rate (down from 11 last month and down from 13 last year).

Treasury Rate Movements, October 2021

The one-month, 20-year, and 30-year rates fell while all other rates rose in October. The yield curve narrowed from the previous month thus ending its widening streak at two months. The one-month bill did not maintain the lowest rate throughout the month and it shared the lowest rate on multiple occasions. There were moves upwards on short-term rates thus increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

EU Long-Term Interest Rates, August 2021

The chart above shows the ten-year interest rate in each EU state as of August 2021, the change from the previous month, and the rate one year prior. Eleven states have a negative interest rate (up from 9 last month and down from 13 last year).

Treasury Rate Movements, September 2021

The six-month rate fell, the three-month rate stayed the same, while all other rates rose in September. The yield curve widened from the previous month thus extending its widening streak to two months. The one-month bill did not maintain the lowest rate throughout the month and it shared the lowest rate on multiple occasions. There were moves upwards on short-term rates thus increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

EU Long-Term Interest Rates, July 2021

The chart above shows the ten-year interest rate in each EU state as of July 2021, the change from the previous month, and the rate one year prior. Nine states have a negative interest rate (up from 4 last month and down from 12 last year).

Older