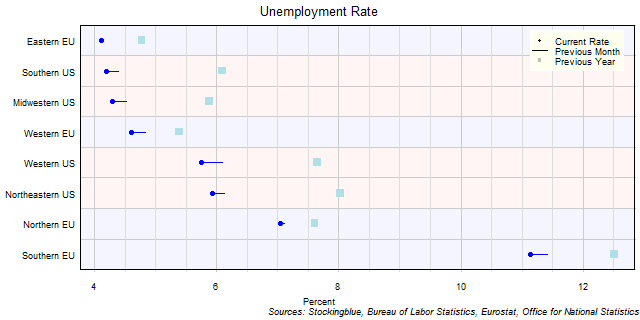

EU and US Regional Unemployment Rates, November 2021

The chart above shows the unemployment rate in each EU and US region as of November 2021 (unless otherwise noted - see caveats below), the change from the previous month, and the rate one year prior. All eight regions saw a drop in the unemployment rate over the previous year.

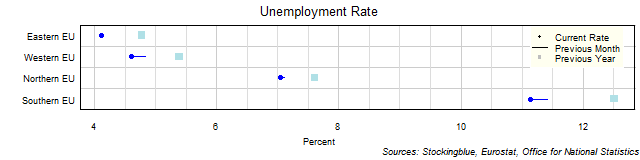

EU Regional Unemployment Rates, November 2021

The chart above shows the unemployment rate in each EU region as of November 2021 (unless otherwise noted - see caveats below), the change from the previous month, and the rate one year prior. All four regions saw a drop in their rate over the previous year.

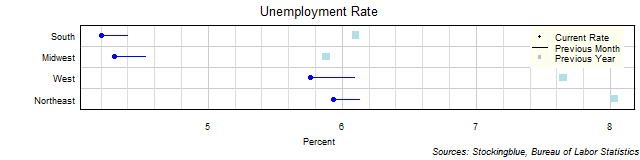

US Regional Unemployment Rates, November 2021

The chart above shows the unemployment rate in each US region as of November 2021, the change from the previous month, and the rate one year prior. All four regions saw a drop in their rate over the previous year.

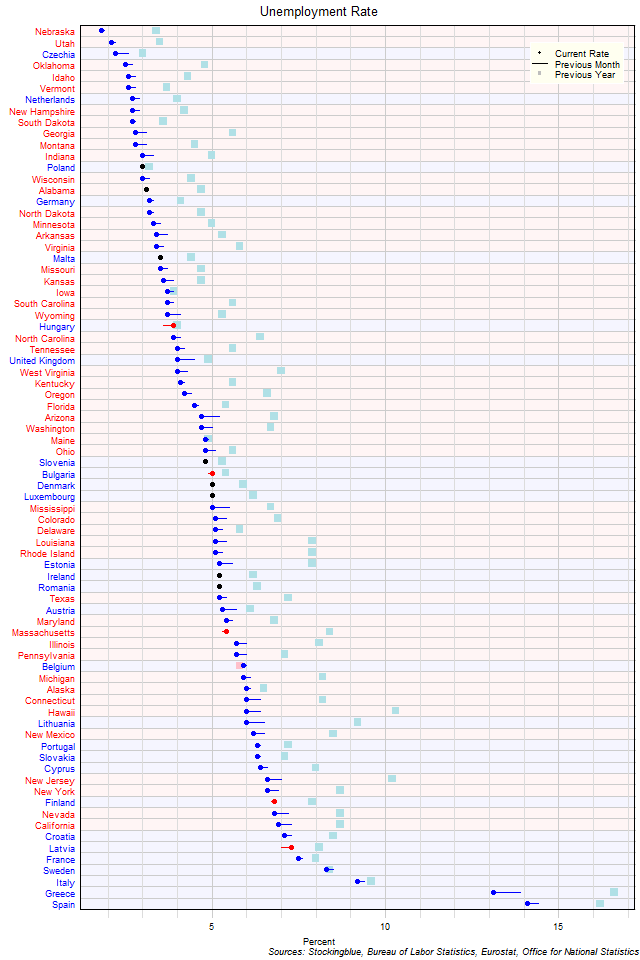

EU and US Unemployment Rates, November 2021

The chart above shows the unemployment rate in each EU and US state as of November 2021 (unless otherwise noted - see caveats below), the change from the previous month, and the rate one year prior. Nebraska, Utah, Czechia, Oklahoma, Idaho, Vermont, the Netherlands, New Hampshire, South Dakota, Georgia, and Montana are the only states with a rate below three percent.

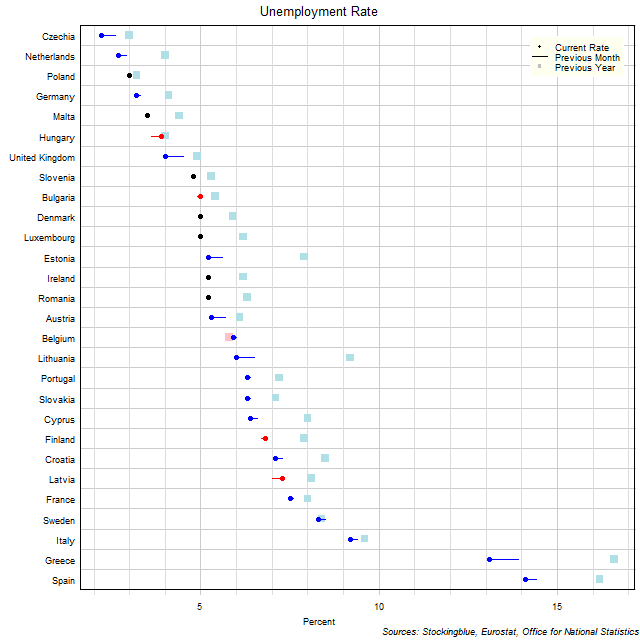

EU Unemployment Rates, November 2021

The chart above shows the unemployment rate in each EU state as of November 2021 (unless otherwise noted - see caveats below), the change from the previous month, and the rate one year prior. Two states have an unemployment rate below three percent.

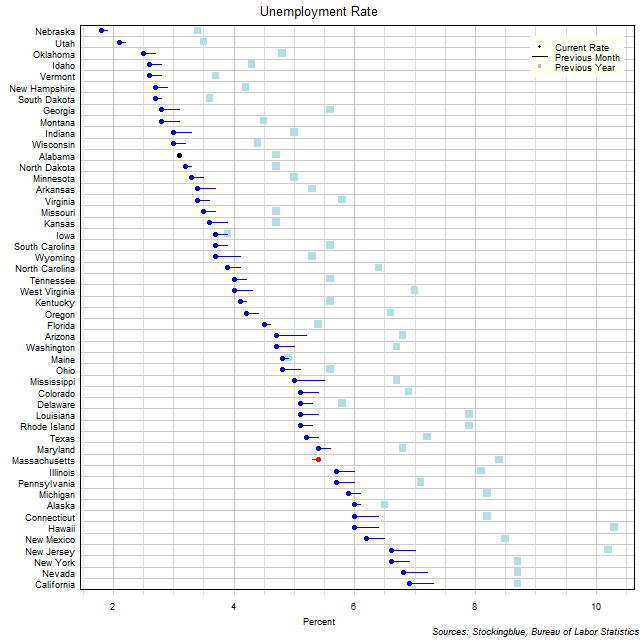

US Unemployment Rates, November 2021

The chart above shows the unemployment rate in each US state as of November 2021, the change from the previous month, and the rate one year prior. Nine states have an unemployment rate below three percent.

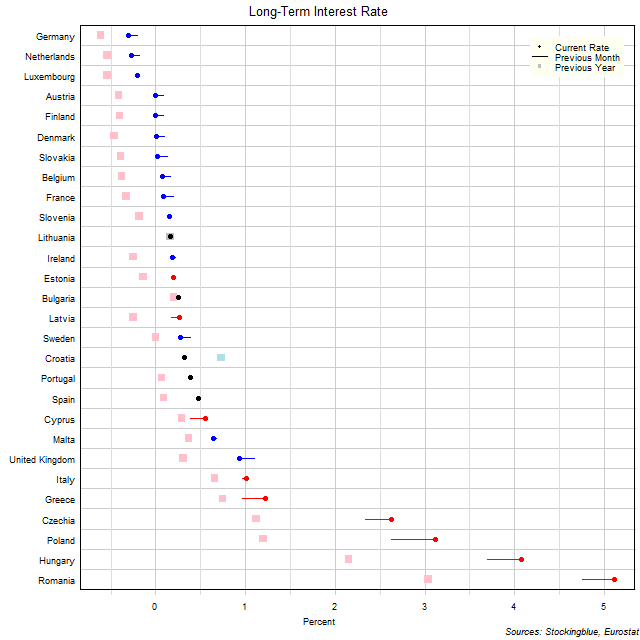

EU Long-Term Interest Rates, November 2021

The chart above shows the ten-year interest rate in each EU state as of November 2021, the change from the previous month, and the rate one year prior. Four states have a negative interest rate (up from 3 last month and down from 13 last year).

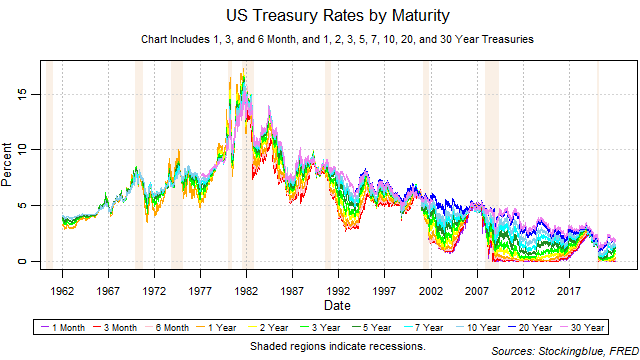

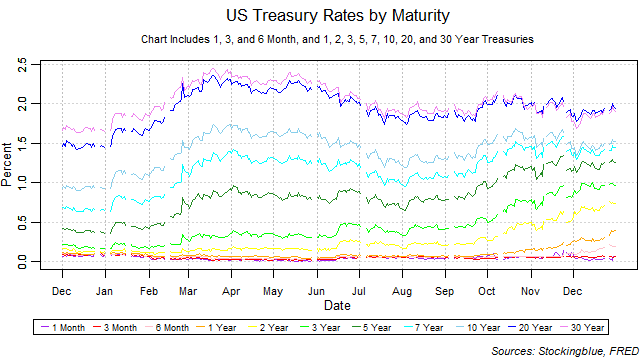

A Look Back at Treasuries in 2021

The one-month and three-month rates trended downwards for the third year in a row while all other rates went up ending their downward trend at two years. The yield curve widened over the course of the year. A narrowing from the short-term is a warning sign for an inversion that indicates recession.

Treasury Rate Movements, December 2021

The one-month rate fell while all other rates rose in December. The yield curve widened from the previous month thus ending its narrowing streak at two months. The one-month bill did not maintain the lowest rate throughout the month and it shared the lowest rate. There were no major moves upwards on short-term rates thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

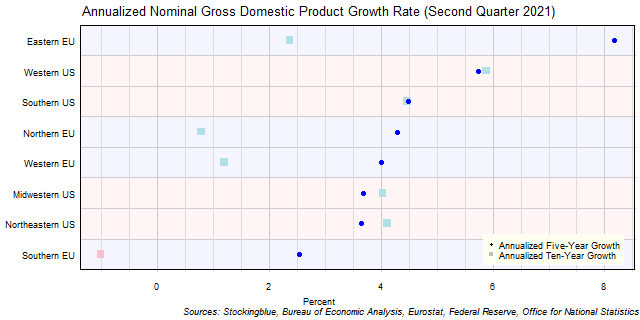

Long-Term EU and US GDP Growth Rate by Region, Second Quarter 2021

The chart above shows the annualized nominal gross domestic product (GDP) growth rate when priced in US dollars in each EU and US region over the past five years as of the second quarter of 2021 and the growth over the past ten years. The Southern EU was the only region that did not experience growth over the past ten years.

Older