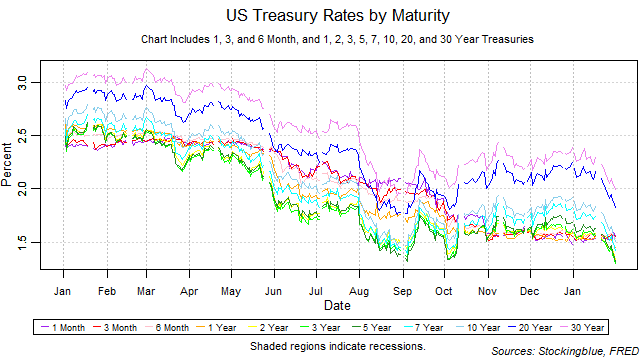

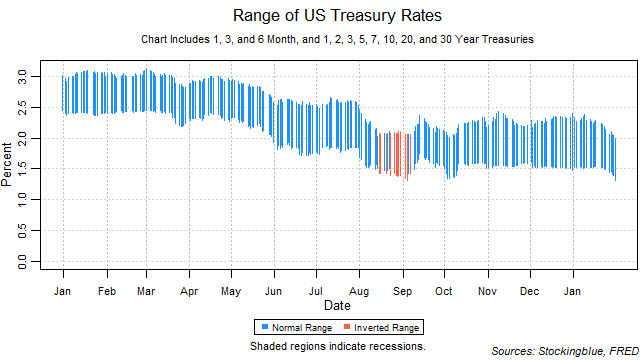

The one-month rate fell in January, the three-month remained unchanged, while all other rates rose. The yield curve narrowed from the previous month thus ending its widening streak of one month. The one-month bill did not maintain the lowest rate throughout the month. Long-term rates fell while short-term rates rose thus increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Findings

- The one-month rate dropped in January. The three-month rate remained the same. All other rates rose.

- The one-month rate saw the largest absolute growth at 0.08 points.

- On a relative basis, the one-month rate grew the most with a 5.41 percent rise.

- The 20-year rate saw the largest absolute drop at 0.42 points.

- On a relative basis, the seven-year rate dropped the most with a 22.40 percent drop.

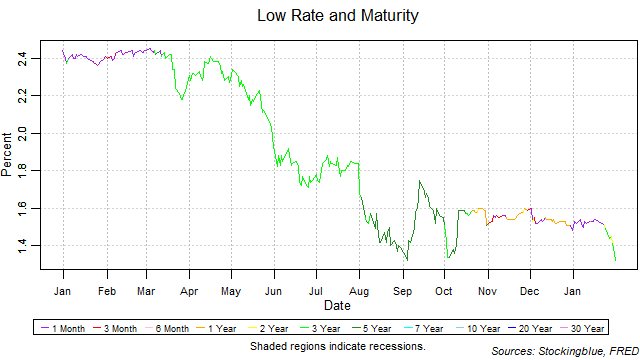

- The one-month bill did not maintain the lowest rate throughout the month. The three-month, one, two, and three-year treasuries also had the lowest rate.

- The yield curve narrowed from 0.91 to 0.67.

Caveats

- As always, past performance is not indicative of future results.

- All figures are rounded to the nearest hundredth.

Details

The breadth of the yield curve narrowed over the month from a range of 0.91 to a range of 0.67. The widest range was 0.85 which was hit on January 8 and January 9 and the narrowest 0.61 which was hit on January 27. The last time the yield curve was this wide was on December 31, 2019 when it hit a range of 0.91.

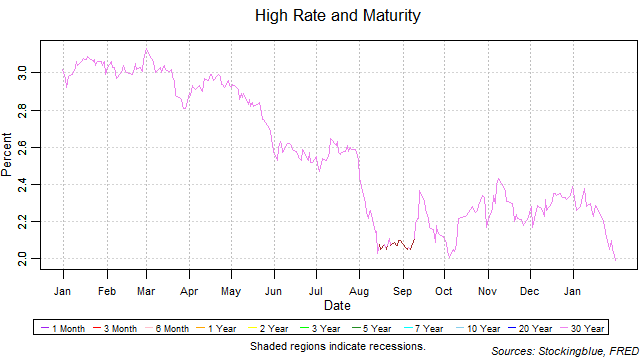

The thirty-year bond held the highest rate throughout the month. However, it dropped steadily throughout the month. It fell below 2.00 percent on January 31. The last time the 30-year rate hit this month's low of 1.99 was on September 4, 2019 when it was at 1.97.

The one-month bill did not hold the lowest rate for every session of the month. The three-month, one, two, and three-year treasuries held the lowest rate on 13 occasions. The one-month did not hit a new 12-month high extending its streak of no new 12-month highs to ten months.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed February 5, 2020, https://fred.stlouisfed.org/categories/115.