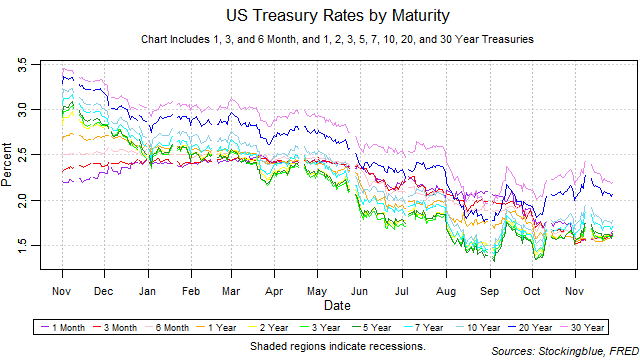

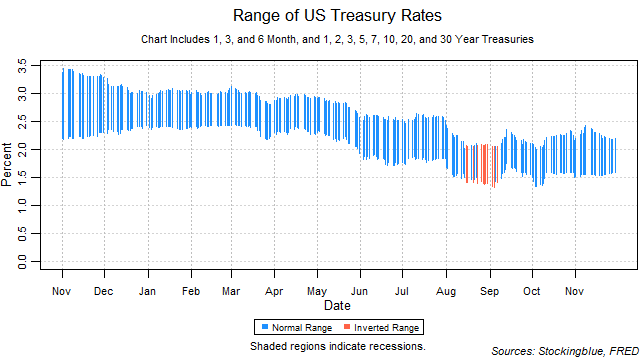

All rates rose rose in November. The yield curve narrowed from the previous month thus ending its widening streak at one month. The one-month bill held the lowest rate three times and shared the lowest rate one time in the month. All rates rose at an even pace thus decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion is a strong indicator for an upcoming recession.

Findings

- All rates rose in November.

- The seven-year note saw the largest absolute rise at 0.13 points.

- On a relative basis, the seven-year note rose the most with a 8.13 percent gain.

- The one-month bill saw the smallest absolute rise at 0.03 points.

- On a relative basis, the 30-year bond rose the least with a 1.84 percent gain.

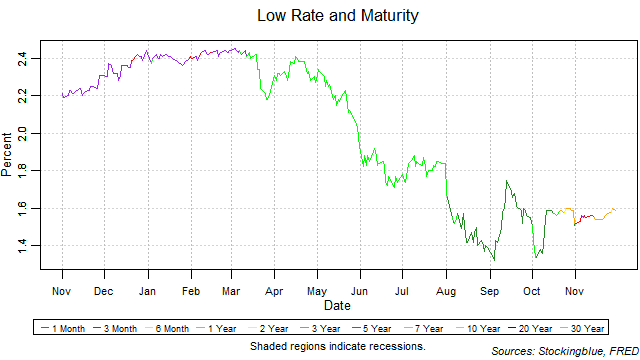

- The one-month bill maintained the lowest rate for three sessions and shared the lowest rate with the three-month bill for one session.

- The one-month, three-month, and one-year bills, and the two-year, three-year, and five-year notes alternately held the lowest rate throughout the month.

- The yield curve has a range of 0.62.

Caveats

- As always, past performance is not indicative of future results.

- All figures are rounded to the nearest hundredth.

Details

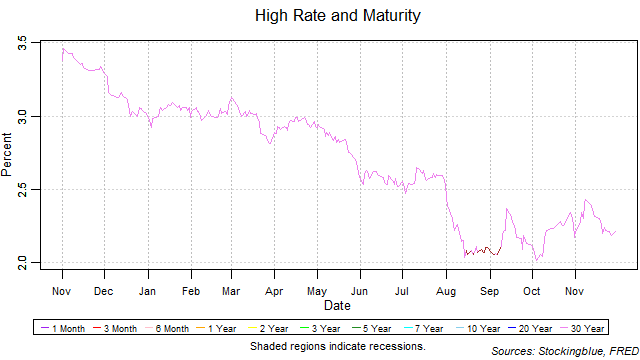

The breadth of the yield curve went from a range of 0.66 to a range of 0.62. The widest range was 0.88 which was hit on November 8 and the narrowest range was 0.59 which was hit on November 27. The last time the yield curve was this wide was on December 3, 2018 when it hit a range of 0.97.

The thirty-year bond held the highest rate throughout the month. The thirty-year bond has dropped below 2.25 percent on nine sessions. The 30-year bond rate has last hit this month's low of 2.17 on October 31, 2019.

The one-month bill held the lowest rate for three sessions of the month and shared the lowest rate on one. The one-month, three-month, and one-year bills, and the two-year, three-year, and five-year notes alternately held the lowest rate throughout the month. The one-month did not hit a new 12-month high extending its streak of no new 12-month highs to eight months.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed December 5, 2019, https://fred.stlouisfed.org/categories/115.