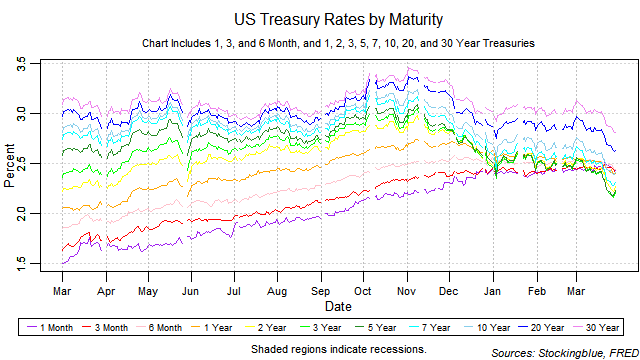

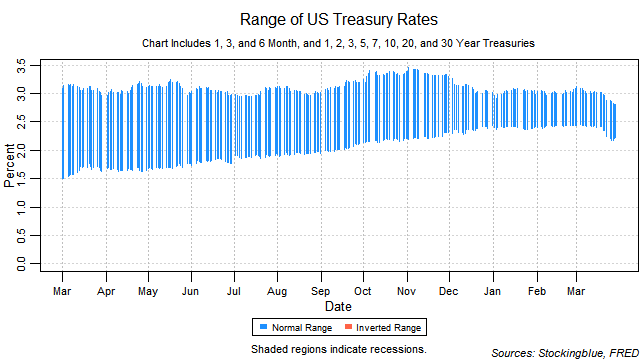

All rates dropped in March. The yield curve shrank from the previous month thus ending its one month widening streak. The one-month bill did not maintain the lowest rate throughout the month. Long-term rates fell at a faster pace than short-term rates thus neutralizing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession. A side note: several financial analysts have recently pointed to inversions between particular rates like the three-year note having a higher rate than the five-year note as being indicators for a recession. The data does not back this up. The only type of inversion that has led to a recession reliably is one in which the highest rate is a shorter-term treasury than the lowest rate. This is the only inversion that has predicted a recession seven out of eight times since 1962. According to this measure, there is no recession in the foreseeable future.

Findings

- All rates dropped in March.

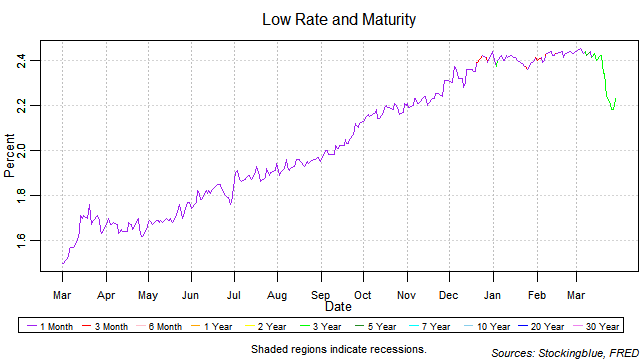

- The one-month rate saw the smallest absolute drop at 0.01 points.

- On a relative basis, the one-month rate dropped the least with a 0.41 percent drop.

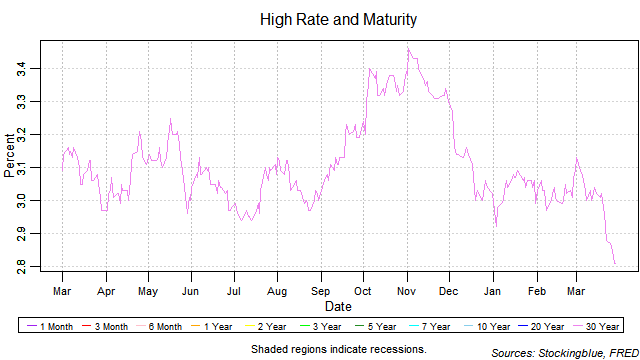

- The seven-year and ten-year rates saw the largest absolute drop at 0.32 points.

- On a relative basis, the seven-year rate dropped the most with a 12.17 percent drop.

- The one-month bill did not maintain the lowest rate throughout the month. On 18 out of 22 sessions the one-month rate either did not have the lowest rate or shared it with another maturity.

- The yield curve dropped 0.07 points to 0.58.

Caveats

- As always, past performance is not indicative of future results.

- All figures are rounded to the nearest hundredth.

Details

The breadth of the yield curve narrowed 0.07 points over the month to a range of 0.58. The widest range was 0.69 (0.04 points higher than the previous month's widest range of 0.65) which was hit on March 1 and the narrowest 0.58 (0.04 points higher than the previous month's narrowest range of 0.54) which was hit on March 8 and March 29. The last time the yield curve was this narrow was on February 26, 2019 when it hit a range of 0.58.

The thirty-year bond held the highest rate throughout the month. However, it has been dropping precipitously throughout the course of March. It has fallen below 3 percent on March 20 and has not gone above it since. It should be noted that all other rates remained below the 3 percent threshold throughout the month. The last time the 30-year rate hit this month's low of 2.81 was on January 8, 2018 when it was at 2.81.

The one-month bill did not hold the lowest rate for every session of the month. The one-month bill shared the lowest rate on two occasions: with the three-month bill on March 1 and with the five-year note on March 11. The three-year note shared the lowest rate with the five-year note on seven occasions. The five-year note held the lowest rate one time on March 8 while the three-year note held it on eight occasions. The one-month hit a new 12-month high ending its two month streak of no new 12-month highs. The last time the three-year note held the lowest rate was on January 3, 2019, but that was only for one session. The last time it held the lowest rate for a sustained period of time was on November 27, 2007.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed April 3, 2019, https://fred.stlouisfed.org/categories/115.