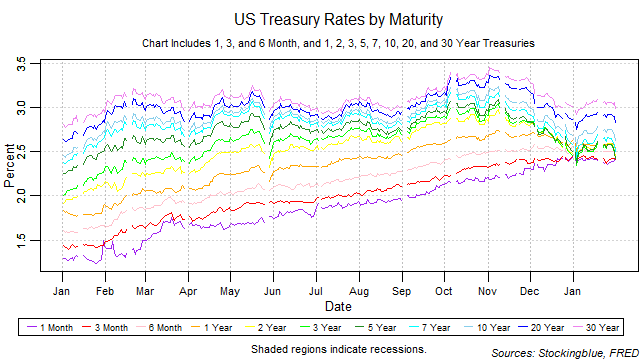

All rates dropped in January. The yield curve remained flat from the previous month thus ending its narrowing streak of two months. The one-month bill did not maintain the lowest rate throughout the month. Long-term and short-term rates dropped at about the same pace thus neutralizing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Findings

- All rates dropped in January.

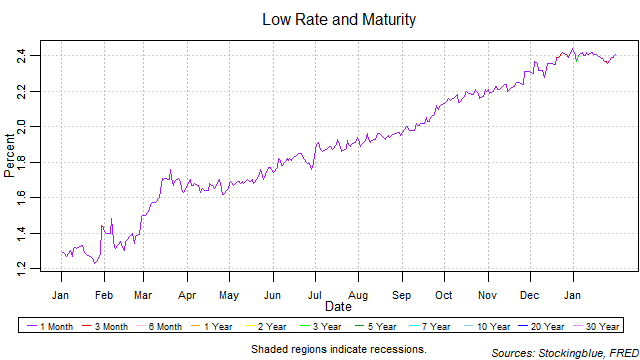

- The one-month rate saw the smallest absolute decline at 0.02 points.

- On a relative basis, the one-month rate dropped the least with a 0.82 percent drop.

- The six-month rate saw the largest absolute drop at 0.10 points.

- On a relative basis, the six-month rate dropped the most with a 3.91 percent drop.

- The one-month bill did not maintain the lowest rate throughout the month. On three occasions, the three-month bill had the lowest rate.

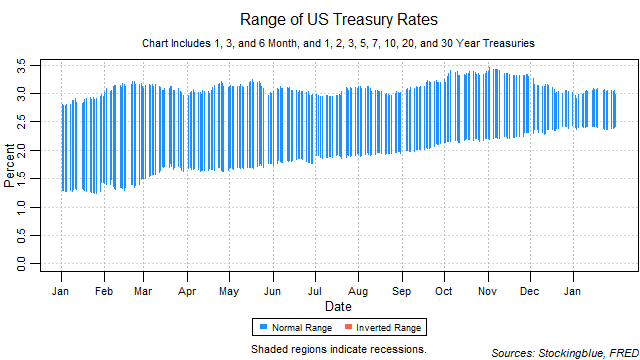

- The yield curve remained at 0.58.

Caveats

- As always, past performance is not indicative of future results.

- All figures are rounded to the nearest hundredth.

Details

The breadth of the yield curve stayed the same over the month at a range of 0.58. The widest range was 0.70 (0.27 points lower than the previous month's widest range of 0.97) which was hit on January 23 and 25 and the narrowest 0.55 (0.04 points lower than the previous month's narrowest range of 0.59) which was hit on January 3. The last time the yield curve was this narrow was on August 13, 2007 when it hit a range of 0.55.

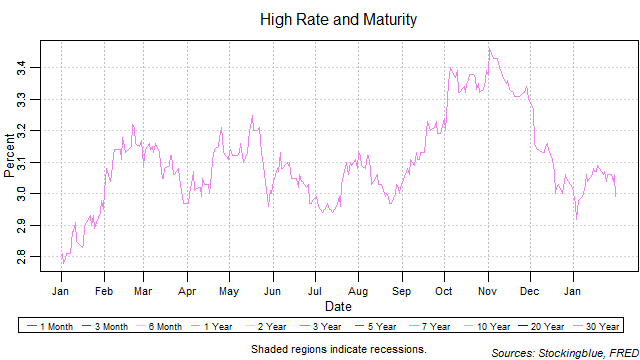

The thirty-year bond held the highest rate throughout the month. It dropped and rose in the beginning of the month, leveled off in the middle and saw a drop again at the end of January. It has fallen below 3 percent on five different occasions, four in the beginning of the month and once on the last trading day of the month. It should be noted that all other rates remained below the 3 percent threshold throughout the month. The last time the 30-year rate hit this month's low of 2.92 was on January 26, 2018 when it was at 2.91.

The one-month note did not hold the lowest rate for every session of the month. The three-month bill held the lowest rate on three occasions: January 3, January 24, and January 31. The one-month did not hit a new 12-month high for the first time in nine months.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed February 5, 2019, https://fred.stlouisfed.org/categories/115.