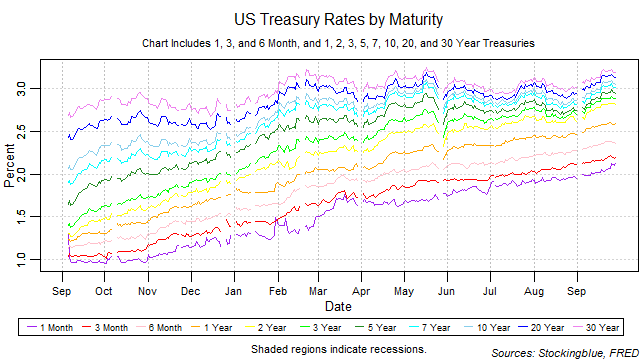

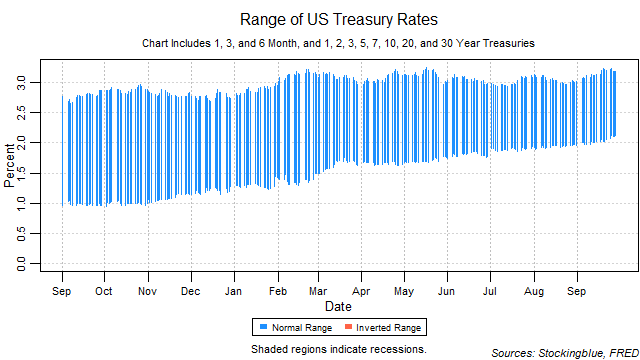

All rates rose in September. The yield curve remained the same as the previous month thus ending its narrowing streak at four-months. The one-month bill maintained the lowest rate throughout the month. All rates rose at a somewhat similar pace to each other keeping the risk of an inversion brought upon by rising short-term rates at the same level as the previous month. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Findings

- All rates rose in September.

- The five and seven-year rates saw the largest absolute growth at 0.20 points.

- On a relative basis, the one-month rate grew the most with a 8.72 percent rise.

- The three and six-month rates saw the smallest absolute growth at 0.08 points.

- On a relative basis, the six-month rate rose the least with a 3.51 percent rise.

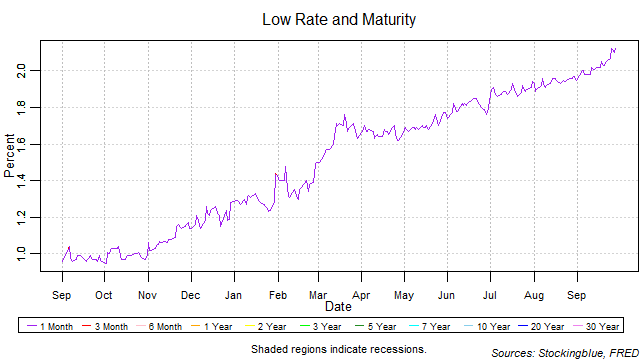

- The one-month bill maintained the lowest rate throughout the month.

- The yield curve stayed the same.

Caveats

- As always, past performance is not indicative of future results.

- The rates have been at historic lows for quite some time which has not occurred previously.

- All figures are rounded to the nearest hundredth.

Details

The breadth of the yield curve stayed the same over the month from a range of 1.07 to a range of 1.07. The widest range was 1.20 (0.03 points lower than the previous month's widest range of 1.23) which was hit on September 19 and the narrowest 1.07 (0.05 points higher than the previous month's narrowest range of 1.02) which was hit on September 4 and 28, the first and last trading days of the month.

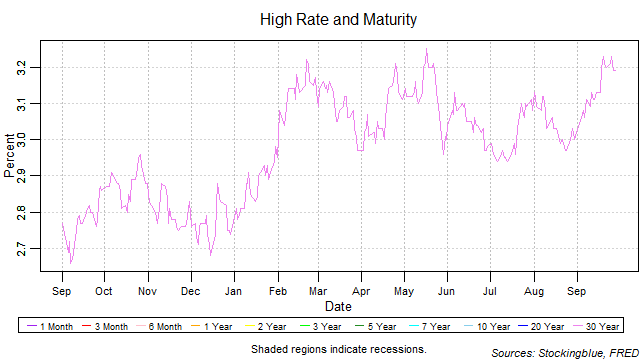

The thirty-year bond held the highest rate throughout the month. It rose steadily in the first half of the month only to plateau and drop off slightly in the final trading days. It has remained above 3 percent for the entire duration of the month. It should be noted that the seven, ten, and 20-year rates were above 3 percent on several trading days of the month. The 20-year rate has been consistently above 3 percent from September 7 onwards and the seven and ten-year rates have been consistently above 3 percent since September 18.

The one-month note held the lowest rate for every session of the month. However, it has hit a new 12-month high for the fifth time in five months and has not been as high as 2.12 (its high for the month) since February 27, 2008 when it was at 2.21.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed October 1, 2018, https://fred.stlouisfed.org/categories/115.