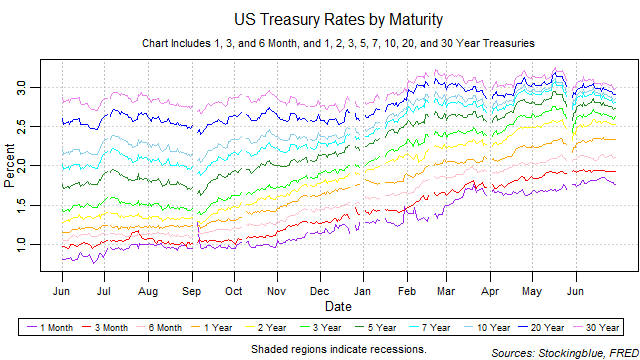

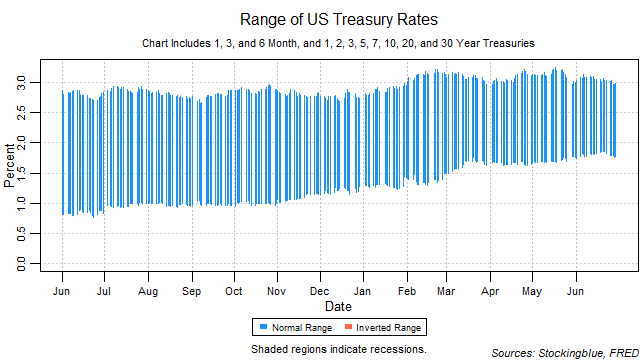

The 30-year rate was the only one to drop in June while the three-month and the 20-year rates remained steady and all other rates rose. The yield curve narrowed from the previous month and extended its narrowing streak to two-months. The one-month bill maintained the lowest rate throughout the month. Although short-term rates rose, they did not rise as rapidly as the 30-year dropped and thus the yield curve narrowed mostly from the top decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Findings

- The 30-year rate dropped in June while the three-month and 20-year rates remained steady. All other rates rose.

- The two-tear rate saw the largest absolute growth at 0.12 points.

- The 30-year rate saw the largest drop at 0.02 points.

- On a relative basis, the two-year rate grew the most with a 5.00 percent rise.

- The 30-year rate dropped the most on relative terms with a 0.67 percent drop.

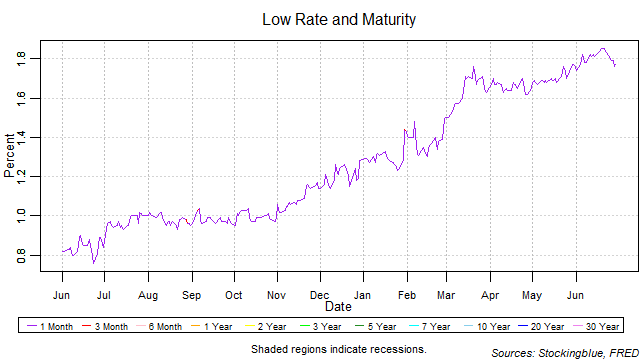

- The one-month bill maintained the lowest rate throughout the month.

- The yield curve narrowed 0.03 points.

Caveats

- As always, past performance is not indicative of future results.

- The rates have been at historic lows for quite some time which has not occurred previously.

Details

The breadth of the yield curve narrowed over the month from a range of 1.24 to a range of 1.21. The widest range was 1.32 (0.23 points lower than the previous month's widest range) which was hit on June 6 and the narrowest 1.17 (0.02 points lower than the previous month's narrowest range) which was hit on June 19.

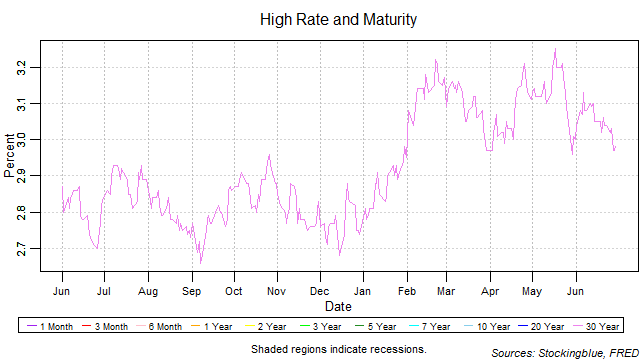

The thirty-year bond held the highest rate throughout the month. It peaked in the beginning of the month only to drop steadily over the remainder of June. It has dropped below 3 percent on June 27 and remained below it until the last trading day of the month. It should be noted that the 20-year rate has also risen above 3 percent on seven trading days early in the month.

The one-month note held the lowest rate for every session of the month. However, it has hit a new 12-month high for the second time in two months and has not been as high as 1.85 (its high for the month) since July 8, 2008 when it was at 1.86.

Sources

"Treasury Constant Maturity," Federal Reserve Bank of St. Louis, accessed June 12, 2018, https://fred.stlouisfed.org/categories/115.