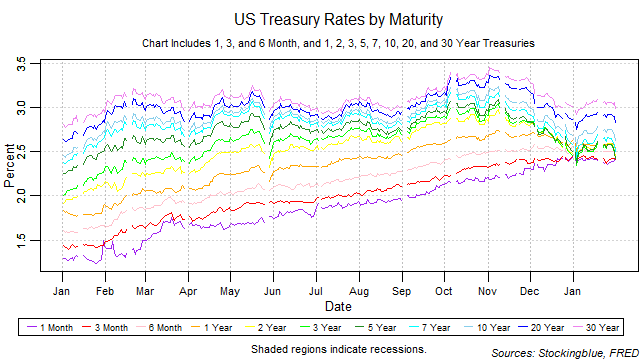

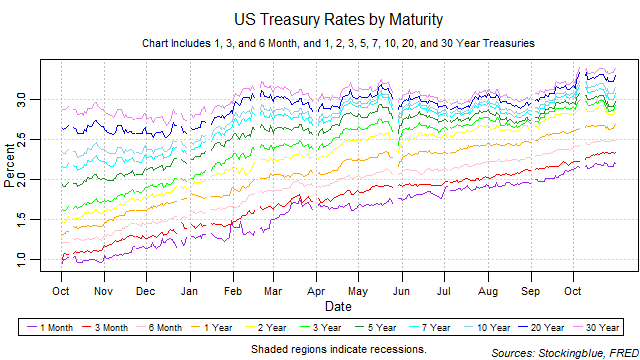

Treasury Rate Movements, January 2019

All rates dropped in January. The yield curve remained flat from the previous month thus ending its narrowing streak of two months. The one-month bill did not maintain the lowest rate throughout the month. Long-term and short-term rates dropped at about the same pace thus neutralizing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

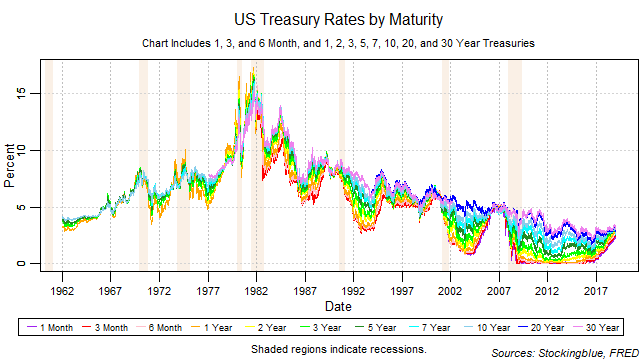

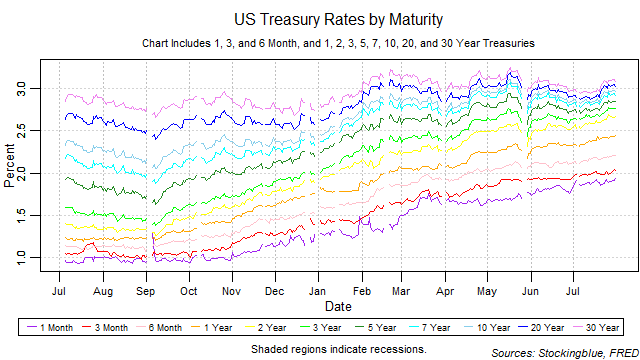

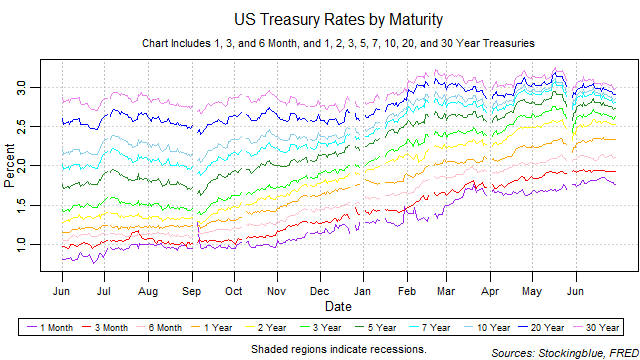

A Look Back at Treasuries in 2018

Short-term rates continued their dramatic turn upwards after being stuck at zero for several years while long-term rates made steady advances as well. The yield curve continued to narrow and it also narrowed from the bottom up. A narrowing from the short-term is a warning sign for an inversion that indicates recession.

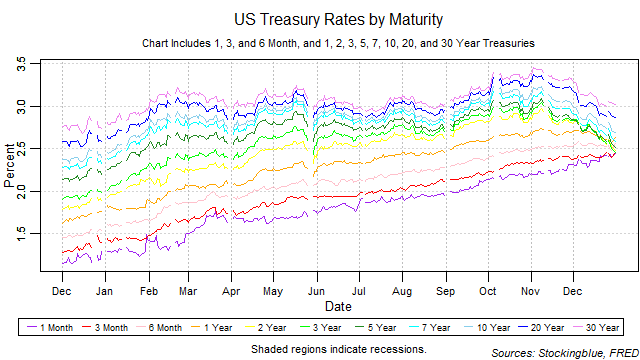

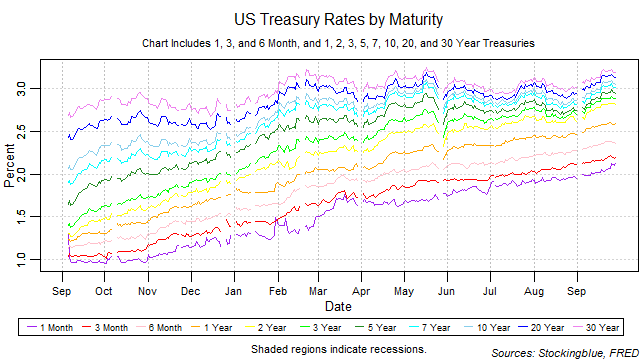

Treasury Rate Movements, December 2018

The one, three, and six-month rates rose in December while all other rates dropped. The yield curve narrowed from the previous month thus extending its narrowing streak to two months. The one-month bill did not maintain the lowest rate throughout the month. Long-term rates fell while short-term rates rose thus increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

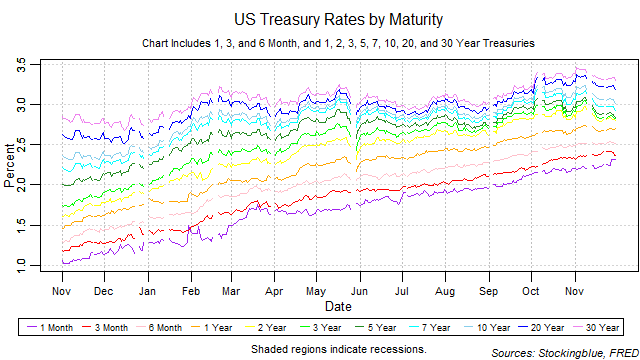

Treasury Rate Movements, November 2018

The one, three, and six-month, and the one-year rates rose in November while all other rates dropped. The yield curve narrowed from the previous month thus ending its one month widening streak. The one-month bill maintained the lowest rate throughout the month. Long-term rates fell while short-term rates rose thus increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Treasury Rate Movements, October 2018

All rates rose in October. The yield curve widened from the previous month thus ending its two month steady streak. The one-month bill maintained the lowest rate throughout the month. All rates rose at a somewhat similar pace to each other keeping the risk of an inversion brought upon by rising short-term rates at the same level as the previous month. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

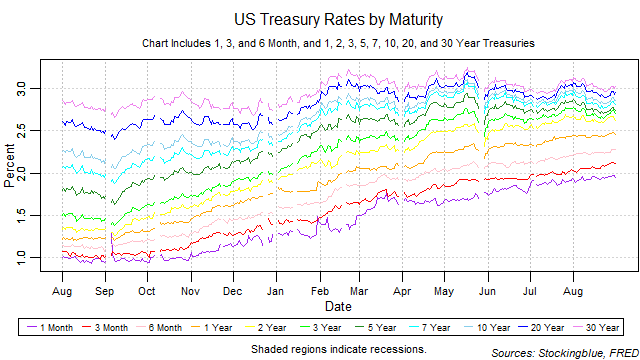

Treasury Rate Movements, September 2018

All rates rose in September. The yield curve remained the same as the previous month thus ending its narrowing streak at four-months. The one-month bill maintained the lowest rate throughout the month. All rates rose at a somewhat similar pace to each other keeping the risk of an inversion brought upon by rising short-term rates at the same level as the previous month. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Treasury Rate Movements, August 2018

All short-term rates and the one-year rate rose in August while all other medium-term and long-term rates dropped. The yield curve narrowed from the previous month and extended its narrowing streak to four-months. The one-month bill maintained the lowest rate throughout the month. Short-term rates rose at a similar pace to the drop in long-term rates thus the yield curve narrowed equally from the bottom and the top keeping the risk of an inversion brought upon by rising short-term rates the same. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Treasury Rate Movements, July 2018

All rates rose in July. The yield curve narrowed from the previous month and extended its narrowing streak to three-months. The one-month bill maintained the lowest rate throughout the month. Short-term rates rose more rapidly than long-term rates thus the yield curve narrowed mostly from the bottom increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

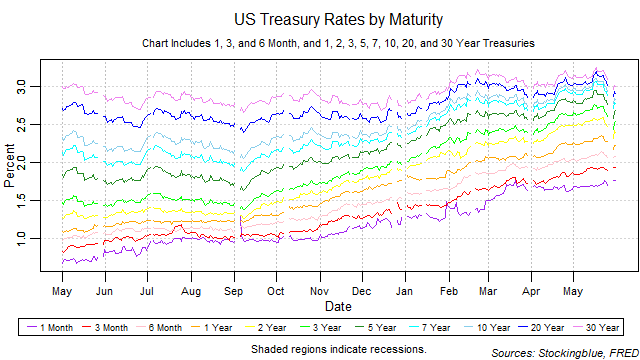

Treasury Rate Movements, June 2018

The 30-year rate was the only one to drop in June while the three-month and the 20-year rates remained steady and all other rates rose. The yield curve narrowed from the previous month and extended its narrowing streak to two-months. The one-month bill maintained the lowest rate throughout the month. Although short-term rates rose, they did not rise as rapidly as the 30-year dropped and thus the yield curve narrowed mostly from the top decreasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

Treasury Rate Movements, May 2018

Short-term rates rose in May while medium and long-term rates dropped. The yield curve narrowed from the previous month and broke its one-month widening streak. The one-month bill maintained the lowest rate throughout the month. As the one-month rate had the largest increase in both absolute and relative terms, the yield curve narrowed from the bottom increasing the risk of an inversion brought upon by rising short-term rates. Such an inversion, if it were to happen would be a strong indicator for an upcoming recession.

OlderNewer