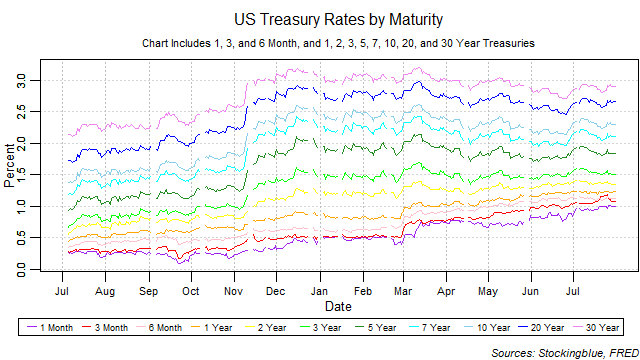

Treasury Rate Movements, July 2017

The month of July found short-term maturities' rates continuing their upward trend that started earlier in the year. Long-term maturities' rates have leveled off after dropping slightly earlier in the year. The upward tick in the short-term maturities' rates is troubling as it is a decent indicator of an ensuing recession. Only three out of eleven previous upticks in short-term rates have not led to an inversion of the yield curve.

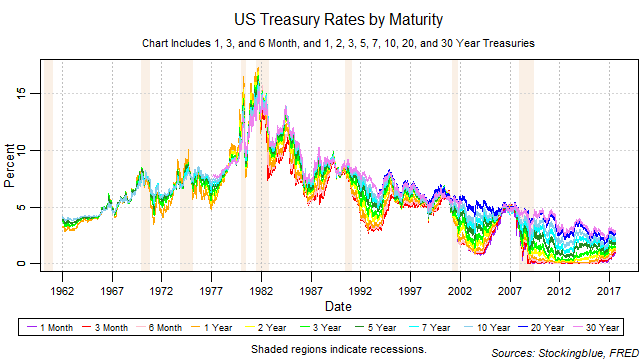

Treasury Rates and Recessions, a Historic View

Treasuries have historically been a great indicator for recessions. The traditional view has been that when the yield curve inverts, a recession is soon on its way. This bond report will show trends and fluctuations in the treasury market from a new perspective. Ranges of rates as well as rates by maturity will be charted and analyzed to look for patterns that will help identify changes in the overall economy.

Newer