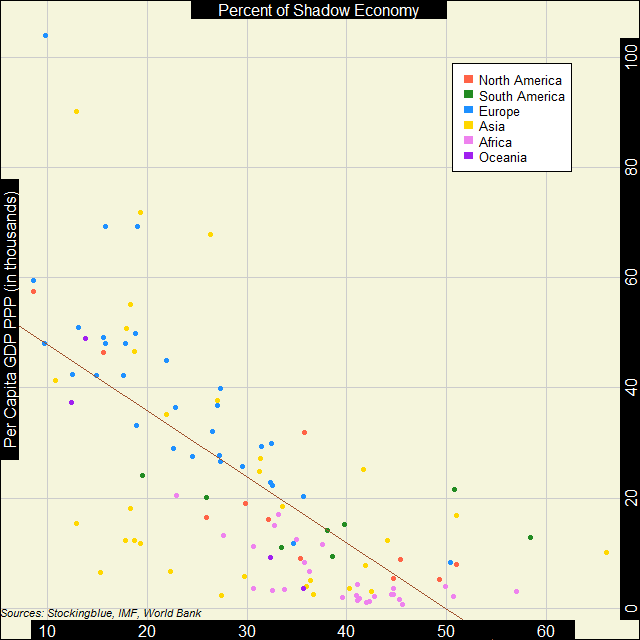

The correlation between economic strength and the strength of the shadow economy is moderate. Europe and Asia have the countries with the highest per capita GDP PPP while all continents except for Oceania have nations whose shadow economies make up more than half of their overall economies.

Findings

- The correlation coefficient between per capita Gross Domestic Product (GDP) in Purchasing Power Parity (PPP) and shadow economies is -0.71.

- As economic strength increases, the shadow economy tends to decrease.

- North America and Europe are the only two continents with countries that have shadow economies that make up less than 10 percent of their overall economies.

- Africa and Asia have many countries whose per capita GDP PPP is low.

- Asia is the only continent that has a country whose shadow economy makes up more than 60 percent of its overall economy.

Caveats

- As always, correlation does not imply causation.

- Several countries are not included as they were missing data. See the continent reports for complete lists.

- The GDP data is from 2016 while the shadow economy data is the average from 1999-2006.

Details

Asia is the only continent where countries that have a per capita GDP PPP of less than 20,000 international dollars also have a shadow economy of less than 20 percent of the overall economy.

Africa has the greatest number of countries whose shadow economies take up over 40 percent of their overall economies. It also only has one country that has a per capita GDP PPP of over 20,000 international dollars and has no countries whose shadow economy takes up less than one-fifth of the overall economy.

Sources

Schneider, Friedrich, Andreas Buehn, and Claudio E. Montenegro. 2010. "Shadow Economies All over the World: New Estimates for 162 Countries from 1999 to 2007." The World Bank Development Research Group.